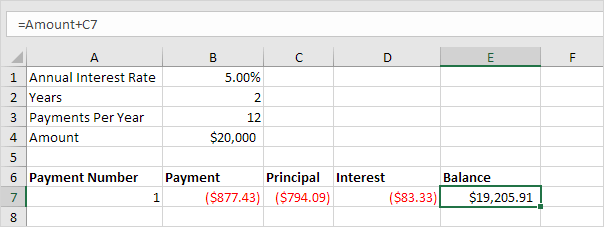

Interest: this column shows the amount of the monthly payment that is associated with interest charges.Principal: this column of information shows the amount of the monthly payment that is applied towards reducing the principal of the loan.From this complex calculation comes the monthly payment on the loan.

Fortunately, Excel and other spreadsheet products have this formula built into the application. Loan Payment: perhaps the most mysterious calculation used in an amortization schedule because it relies on a complex formula.For example, a 36 month car loan will use an amortization table with 36 rows of information one for each monthly payment. Month: this column reflects the payment of the loan over time.The most common format for these tables includes columns of data containing the following information: From the above three pieces of information, it's possible to produce all of the calculations or formulas needed to produce an amortization table.

0 kommentar(er)

0 kommentar(er)